While the world has changed during the past century, one could argue that the same kind of remote microgrids first developed by Edison now represent one of the largest markets for smart grid innovation and distributed energy resources (DER). However, today’s remote microgrids target niche markets such as commodity extraction facilities not connected to an existing grid, physical islands burning diesel fuel for power, rural villages in the developing world, and mobile and tactical applications for military agencies.

The key market drivers of today’s remote microgrid market are as follows:

- Declining cost of solar photovoltaic (PV) technologies

- Rising costs of diesel fuel, the default generation choice for much of the developing world and for physical and commodity extraction off-grid applications

- Investments in more advanced energy storage options, many of which are ideally suited for remote microgrid applications

- Efforts by non-governmental organizations and governments to provide universal access to energy in the developing world

- Efforts by large technology companies, such as ABB, Boeing, General Electric (GE), Lockheed Martin, Siemens, Samsung, SMA, and Toshiba, to secure a place in the emerging microgrid market

- Growing interest among financial institutions on new business models for energy delivery, including onsite power generation

- The proliferation of cell phone usage, which is prompting demand for electricity in remote regions of the world, providing a model of technology dispersal that mimics the Internet and is more aligned with microgrids than traditional utility distribution systems

“Remote microgrids, especially ones that operate on physical islands, are viewed by the market as low-hanging fruit,” says Peter Asmus, principal research analyst with Navigant Research. “Since remote microgrids are the most lucrative of current microgrid opportunities, in terms of per-megawatt vendor revenues, we are witnessing an influx of firms, both large and small, trying to figure out the best business model to deploy. Not surprisingly, the largest number of remote microgrids is being deployed in the developing world, although activity is also increasing in Europe and North America.”

The International Energy Agency (IEA) estimates that by 2020, developing countries will need to double electrical power output. Demand for energy, especially electricity, is growing more rapidly in these nascent economies than the rate of expansion of conventional electricity grids in the major industrialized world. All told, the developing nations will represent 80% of total growth in energy production/consumption by the year 2035. One could safely assume that the majority of these new power supplies will be produced and distributed via remote microgrids and other related forms of DER.

The remote microgrid market epitomizes the promise and the perils attached to new business models that shake up the status quo. Although the term microgrid once applied almost exclusively to off-grid hybrid systems, it now refers more commonly to grid-tied systems that deploy smart grid technologies. From a vendor revenue perspective, remote systems are remarkably robust because of assumed 24/7 performance, which requires significant investments in both hardware and software. On a per-kilowatt basis, remote microgrids represent a 50% to 100% cost premium over equivalent grid-tied microgrid installations; therefore, the smaller the system, the higher the per-unit value.

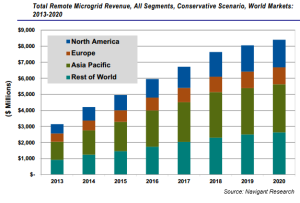

Just how valuable is the remote microgrid market? As illustrated in Chart 1.1, the conservative scenario created by Navigant Research suggests that this market already exceeds $3 billion in hardware and software sales and will grow to more than $8 billion by 2020. Until then, Asia Pacific and the Rest of World regions, including Latin America, Africa, and the Middle East, will increase their respective market shares.

Source: Remote Microgrids — Commodity Extraction, Physical Island, Village Electrification, and Remote Military Microgrids: Global Market Analysis and Forecasts. Published 3Q 2013 by Navigant Research. Excerpts reprinted with permission.