The market for direct current (DC) distribution networks is not a single, cohesive market. Rather, it encompasses several disparate opportunities — data centers, green telecommunications towers, DC subsystems within grid-tied commercial buildings, and off-grid military networks — that revolve around different market assumptions, dynamics, and drivers.

The market for direct current (DC) distribution networks is not a single, cohesive market. Rather, it encompasses several disparate opportunities — data centers, green telecommunications towers, DC subsystems within grid-tied commercial buildings, and off-grid military networks — that revolve around different market assumptions, dynamics, and drivers.

According to a new report by Navigant Research, loads being served by today’s alternating current (AC) power grids are increasingly natively DC. In fact, according to some estimates, approximately 80% of loads in commercial and residential structures are now DC. Given the enormous political and policy support for inverter-based native DC power sources, it makes sense to reduce DC-AC-DC conversion losses and integrate DC distribution networks into power supply infrastructure. Or so goes the argument on behalf of DC.

Understanding Direct Current

There is heated debate today about the advantages and disadvantages of DC. Here are just a few of the myths that need to be debunked, according to DC advocates, in order for this class of power distribution equipment to become mainstream:

- DC is only 1% or 2% more efficient, so why bother? While perhaps true at low voltage levels, research by a variety of entities that include Lawrence Berkeley National Laboratory (LBNL) shows that medium voltage (380V DC) is 7% to 8% more efficient than AC.

- DC requires large conductors and can only be transmitted for a few meters at a reasonable cost. Again, this applies to the majority of systems deployed today at the 12V, 24V, or 48V levels, but it does not hold true at the 380V medium voltages now being developed for distribution networks.

- If a network is run off of DC batteries, this eats up all of the efficiency gained by the DC current. While there is some validity to this fear, it is equally true that this may be an appropriate tradeoff for a reliability gain that can reach 1,000%.

- Arc flash is an unacceptable hazard for DC. Again, new technologies, such as magnetic arc breakers and switched interlocks, can address these safety concerns at a relatively modest cost.

- AC is safer because the voltage crosses zero at either 50 or 60 times per second (i.e., 50 Hz or 60 Hz AC grids). This is only true if the current is not leading or lagging. While components are currently more expensive to address such issues, these extra costs can be offset by large cost savings at the higher voltage distribution level due to a 10% to 15% gain resulting from simplicity in system design.

At present, the majority of progress in developing DC-based technologies has occurred at either the high-voltage (more than 1,000V) or low-voltage (less than 100V) level of electricity service. Since microgrids typically operate at medium voltage (~380-400V), much work needs to be done to bridge this voltage innovation gap. This is the focus of technology companies such as ABB, Intel, Johnson Controls, Inc. (JCI), Emerson Network Power, and others.

Market Forecast Overview

Ironically, the most successful markets profiled in Navigant’s report are low-voltage (24V and 48V) DC systems for telecom towers. Increasingly, those towers are becoming anchor loads for networks expanding into village power systems with formats unique to the developing world, especially India and Africa. In fact, the Asia Pacific region is the clear market leader in DC distribution networks today with approximately 116 MW of annual online capacity, more than 98% of this in the telecom/village anchor market segment. Demand for mobile phones in this region and need for rural electrification in densely populated countries such as India leads the overall DC network market.

The market story line for the Rest of World region echoes that of Asia Pacific, with an even more extreme dominance by telecom/village power systems. Given that this broad geography includes Africa — the focus of current philanthropic and non-governmental organization (NGO) activity related to mitigation of energy poverty — this should come as no surprise.

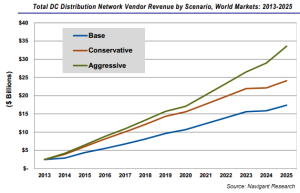

As per the conservative scenario, the revenue that will flow to the four segments of the DC distribution network markets profiled in Navigant’s report starts at $2.5 billion in 2013 and will increase to $24.1 billion annually by 2025.

Source: From Direct Current Distribution Networks by Navigant Research, 2Q 2013. Reprinted by permission.