*NYSERDA

New proposals, plans, projects in progress, and completed deployments of off-grid and utility microgrids worldwide fueled another quarter of strong growth in the fledgling microgrid market, according to Navigant Research’s ¨Microgrid Deployment Tracker 2Q’16.¨

The nearly 1,600 microgrid projects Navigant identified worldwide have a combined generation capacity of 15 gigawatts (GW), an indication of the extent and degree to which stakeholders are turning to distributed zero- and low-emissions microgrids to enhance energy security, reliability, efficiency, and resiliency and to reduce power sector greenhouse gas (GHG) emissions. All told, the benefits are expected to tally up to significant cost savings, as well as substantially enhanced electricity access and grid performance for consumers and societies worldwide.

“Microgrids are popping up like mushrooms all over the world,¨ report author and Navigant Associate Director Peter Asmus tells HOMER Energy. “One notable trend is the dominance of the remote microgrid sector, which represents virtually half of all capacity. The biggest surprise since this report was first published in 2011 is the growth in utility distribution microgrids.”

Tracking Microgrids’ Rise

¨Apparently, utilities may have not anticipated the growth in rooftop solar PV,” continues Asmus. They “want to figure out how microgrids can help them manage this growth by combining rooftop solar generation with energy storage, smart inverters and new software products and services that allow microgrids to help bolster reliability of the distribution system.”

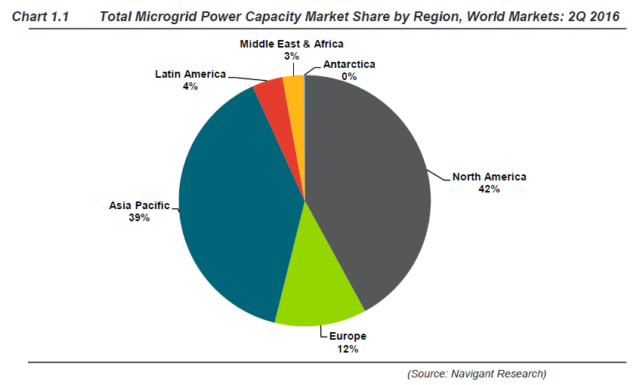

Navigant has added 148 projects with a total 2 GW capacity to its global microgrid project database since its last published update this past December, the Boulder, Colorado-based new energy market research specialist highlights in a May 31 news release. More than half the projects are in North America, which overtook Asia-Pacific as the world region with the highest share – 42 percent – of the global market,

Navigant’s ¨Microgrid Deployment Tracker 2Q’16¨ includes data on known grid-tied and remote microgrid projects in the proposal, planning, and deployed stages across in six geographic regions. Navigant divides the market into seven segments based on the type of end-user or distinguishing type of technology:

- Commercial and Industrial

- Community

- Utility distribution

- Institutional/campus

- Military

- Remote

- Direct current (DC) systems

Just coming up with a widely acceptable definition of a microgrid is no small or straightforward task given the wide variety of shapes, sizes, and configurations they can take, Navigant notes. Navigant defines a microgrid as follows:

“…a distribution network that incorporates a variety of possible distributed energy resources that can be optimized and aggregated into a single system that can balance loads and generation with or without energy storage and is capable of ‘islanding´ whether connected or not connected to a traditional utility power grid.”

The high level of competition in what is a young and fast-moving market, as well as the lack of any sort of specific reporting requirements, adds to the challenges of comprehensively and accurately tracking microgrid projects. ¨Many vendors claim to have large project portfolios, but due to client sensitivity and a desire to remain opaque in business development efforts, [the vendors] did not reveal project details for publication in this report,¨ says Asmus.

¨Numerous microgrid developers and integrators have nondisclosure agreements in place,” he explains. “Nevertheless, the microgrid market is inching its way into the mainstream. Despite the challenges in tracking down data, this update documents an overall increase in capacity of more than 1.6 GW compared to the previous update.”

Microgrid market growth drivers

Remote, off-grid microgrid projects dominate Navigant’s deployments tracking service and database, a reflection of greater awareness, interest, and investments in Middle East-Africa, Latin America and Asia-Pacific, Navigant research associate Adam Wilson elaborated. “Additionally, one-fourth of new capacity coming from utility distribution microgrids shows the markets gradual and continuing shift of microgrid developers looking more to utilities instead of traditional third-party vendors.”

Data from Navigant’s 2Q´16 report also highlights a growing number of utility-scale microgrid deployments in areas of both the developing and developed world that have lacked access to grid electricity or where a combination of high energy costs and abundant renewable energy resource potential exists.

A 200 MW solar PV microgrid has been proposed in Senegal, while a similar 202 MW deployment is being considered on the French Mediterranean island of Corsica. In addition, Blue Pillar announced it aims to deploy 211 MWs of microgrid generation capacity in the United States.

A significant number of U.S. microgrid projects fall under the umbrella of New York State’s $40 million NY Prize Program. Navigant added 83 NY Prize microgrid projects to its Tracker database this year. New details about these projects were slim, as NY Prize just entered the second of its three phases.

¨The majority of [the projects] are still in development and awaiting [the results] of feasibility studies before any quantitative data can be collected,¨ the report authors point out.

Turning to microgrid technology and system vendors, Siemens moved in front of ABB as the market leader in terms of generation capacity. Schneider Electric maintained its lead in terms of project numbers.

Navigant’s latest Microgrid Tracker marks the tenth edition of the report. Navigant began microgrid projects and building the Tracker service’s database in 2009. In addition to serving as a data repository, Navigant is now using the service in concert with its proprietary microgrid market analysis, valuation, and forecasting modeling application software.

In addition, Navigant Research’s 2Q´16 report includes specific information about microgrid project numbers and their capacity by type of distributed generation and energy storage, top 10 countries, top 10 U.S. states, and top 10 microgrid companies. Additional project details, such as rated capacity, duration, and types of energy storage for each project, are also included, with data broken out by world region and microgrid market segment.

I am in the solar business with vast approved land, Approved environmental report for development site to implement the 60MW solar park. Currently negotiating tariff. PPA with the sole grid company. Looking 4suitable partners to implement project located within grassroots communities.

The article is very fascinating wonder if Southern Africa can be considered for funding. If so how?