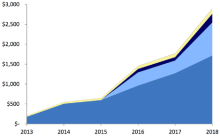

Oft-regarded as an inevitability, the concept of coupling solar with energy storage has seen an incredible amount of corporate mobilization, both in terms of partnerships and technology development. However, the technology itself remains deployed only in niche applications or small markets, without the champion market it needs to grow demand and infuse both industries with badly needed business. According to a new report from Lux Research, over the next five years the industry will grow at a torrid pace but remain small, at 711 MW of combined solar and storage hardware for a total market of $2.8 billion in 2018. Grid-tied installations account for the vast majority at 675 MW of the total 681 MW installed in 2018. Telecom is the greatest off-grid application, with microgrids trailing but in this niche, developers and suppliers will be able to defend higher profit margins in the face of high diesel fuel prices.

In terms of geographic hot-spots, high electricity prices and a surge into the solar industry have Japan needy for new forms of electricity, and solar is at the forefront of this reformation. Japan leads all other markets by a wide margin — it will install 381 MW of solar coupled with storage in 2018, with Germany in second place at 94 MW. The U.S. will come in third place at 75 MW, with Italy in fourth place at 47 MW. Emerging markets are slowly adopting solar after the industry spent years dependent on Germany and Italy.

While a deployment infrastructure will take years to build — as will a market generally for distributed solar — developers will face similar cost-of-doing-business problems with storage technologies that are experienced with solar today; as the cost of storage comes down, those markets will quickly be economically viable for energy storage coupled with solar systems. Those stakeholders looking to increase business in these types of markets should prepare to be ready to act as energy storage systems decrease below $1,000/kWh and markets start coming online in the 2020 to 2030 timeframe.

Given these timeframes, developers must avoid falling into the same trap that solar suppliers did in 2010 and 2011. As storage is incentivized (or required) in high-penetration solar markets like Germany and Italy, a significant portion — if not a majority — of suppliers will invest heavily in those countries, leaving them susceptible to sharp decreases in incentives or potential caps on new solar installations. Smart developers will develop multiple markets initially, and position themselves to pursue markets like Brazil and Mexico as prices come down in order to reap initial active demand as incentives go offline.

For those that have the market channels and the patience to start small but make money, profit margins will remain higher in off-grid market segments with a standard storage unit having a break-even price between $1,200/kWh and $2,200/kWh. Conversely, most grid-tied scenarios offer a break-even price under $800/kWh. While the off-grid market is forecast to remain smaller than the grid-tied segment, higher value players that boast longer operational lives and more lax maintenance requirements will find traction in the remote off-grid sector.

Winners in the space will be those larger firms that can effectively pilot the technology and place a reputable name for project financiers, while waiting for the market to pick up — and when it does, integrate it into an existing solar or energy storage business unit.

Source: Lux Research report, “Batteries Included: Gauging Near-Term Prospect for Solar/Energy Storage Systems.” Reprinted with permission.