Commercial customers pay for electricity in different ways than residential consumers of energy. As we explained in an earlier blog post, large users pay for the fact that utilities invest in capacity that must be available even if it is only used during peak loads. Utilities solved the problem of generating a return on these assets through the use of “demand charges,”which actually date from the 19th century. This way they recover both the costs of the energy they provide and the capacity that they make available.

Commercial customers pay for electricity in different ways than residential consumers of energy. As we explained in an earlier blog post, large users pay for the fact that utilities invest in capacity that must be available even if it is only used during peak loads. Utilities solved the problem of generating a return on these assets through the use of “demand charges,”which actually date from the 19th century. This way they recover both the costs of the energy they provide and the capacity that they make available.

Demand charges now make up about 25% of overall utility sales to commercial and industrial (C&I) customers nationally. For individual companies, they can represent over 50% of an electricity bill. Energy efficiency measures, used by many commercial and industrial facilities, are a good way to reduce overall energy charges, but they do not necessarily reduce demand charges. We continually hear from clients that they don’t understand how demand charges are calculated and what they can do to reduce them. This confusion is understandable, because the demand charge is usually based on the single highest 15 minute period of energy use in the month. It is further complicated in some areas by “ratchet clauses,” which can cause the worst 15 minute period to set demand charges for a whole year.

New challenges in the industry are further impacting demand charges. The rapid growth of renewable energy is creating sharp, new early-evening demand peaks. This is because successful daytime solar PV generation requires a steep ramping up of electricity production when the sun goes down. Utilities that are seeing substantial renewable penetration want to moderate these steep peaks, as well as recovering their lost revenues. In some states they are raising demand charges, introducing Time-of-Use (TOU) rates and even proposing to extend demand charges to residential customers.

Increasing Complexity

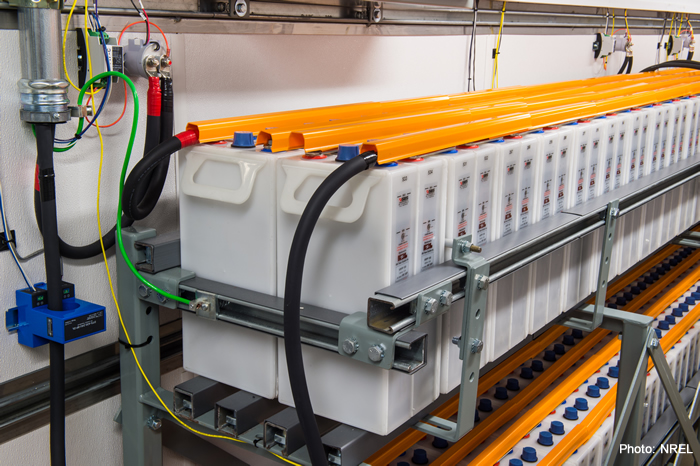

During the past few decades, commercial electricity users have invested in solar systems to reduce their energy costs. But according to a recent study by the National Renewable Energy Laboratory (NREL) and Lawrence Berkeley National Laboratory (LBNL), “Exploring Demand Charge Savings from Commercial Solar,” while solar alone can reduce volumetric energy costs and save money that way, investing in renewable energy without storage is not very good at reducing demand charges. Utilities are shifting their cost structure to reduce energy charges and increase demand charges, which threatens the prospects for strong financial returns on distributed energy investments.

Commercial electricity customers are facing complex and potentially confusing choices. Solar-plus-storage and other distributed energy technologies such as combined heat and power (CHP) and other generators can work together to have reasonable impact on demand charges. Together they can dramatically increase the potential for commercial users to shave peak demand and save money. In another study by NREL and LBNL called “Solar + Storage Synergies for Managing Commercial-Customer Demand Charges,” researchers found that the median demand charge reduction for solar-plus-storage systems is 42% compared to just 7% for standalone PV. But what types of companies are most likely to benefit from these new technologies, just how much can be saved, and how do different types of demand charges matter? In addition to equipment choices, the patchwork of regulatory environments across the country that include different tariff schemes from one utility to the next, and important variations between types of commercial buildings (and thus their load profiles), mean big differences in the potential value of hybrid systems from one commercial customer to the next.

Demand Charge Rate Design Varies Widely

Demand Charge Rate Design Varies Widely

The most basic demand charge is based on a kW price multiplied by the peak demand in a monthly billing period. But, variations in the way demand charges are designed can have significant impacts on the financial benefits provided by solar-plus-storage or other distributed energy systems.

The “Peakyness” of the customer’s load

The customer load profile matters a lot. Customers whose peak loads are more variable and tend to be more extreme are more apt to save money from investing in storage than the ones that have fairly steady peak loads over several hours.

Intervals over which the peak demand is averaged

Many utilities determine power peaks by averaging demand over a 15 minute period, but that interval can range up to an hour. The interval over which the “billing demand” is measured influences how much money a customer saves from solar PV or solar-plus-storage systems. It turns out that solar-plus-storage investments are more effective at reducing demand charges where the rate design has the shortest averaging interval of 15 minutes.

Coincidence of Demand Charges with Peak Loads

Demand charges can be “non-coincident,” which is to say based on customer demand, without regard to the peak demand of the overall utility system. Non-coincident peak charges can be a reasonable choice for covering the utility’s costs for any distribution assets that are dedicated solely to a particular large customer. Coincident demand charges are timed to coincide with utility’s overall peak, which typically occurs in the late afternoon in summer. A growing body of evidence shows that demand tariffs based on coincident peaks are more compatible with distributed energy resources and add more to overall system efficiency. Because the bulk of the utility’s costs are a function of the utility’s peak, they also benefit utilities as well as customers.

Time-of-Use Rates

Finally, there is increasing recognition in the utility community that some combination of Time-of-Use (TOU) rates and demand charges will align price signals more effectively to accommodate increasing penetrations of distributed renewable energy.

How Customer Types Affect Savings from Solar-Plus-Storage and Other Hybrid Investments

Utility tariff structures are not the only relevant factor. Building types – which can be a proxy for customer load profiles, plus the sizing of renewable energy systems, and varying climate conditions across the US – also all influence how much commercial customers can save from solar-plus-storage or other hybrid investments.

Building Types and Customer Load Profiles

The NREL and LBNL study on synergies created by solar-plus-storage systems simulated over a dozen types of commercial buildings in 15 cities across the US to determine which types of customers would save the most. Their key findings were that both the size and narrowness of the building’s peak loads are important:

- Buildings that have a large peak in their load profile, and particularly power demands with a late afternoon peak – such as schools, hotels and apartments – can benefit the most from solar-plus-storage systems.

- Buildings with narrow peak demand periods present the best opportunity for renewable energy systems with storage to reduce their peak demands.

Does Size Matter?

Numerous studies of solar-plus-storage benefits have demonstrated diminishing returns from increasing the size of solar PV and battery systems, in terms of their ability to reduce demand charges. Understanding these diminishing returns to scale is important for system designers to be able to optimize the system configuration and component sizing for the best financial returns. Also, areas that have a strong solar resource but are otherwise subject to intermittent cloud cover, such as Miami and Hawaii, tend to benefit the most from solar-plus-storage systems. In these locations, the system can buffer variations in solar production that might otherwise trigger demand charges.

HOMER Grid Simplifies Decisions about Distributed Energy Resource Investments

Storage systems have a far more dramatic impact on demand charge reduction than PV because storage systems add flexibility, discharging power outside hours of high solar production, and smoothing out peaks caused by intermittent cloud cover. Solar, on the other hand, is great at reducing energy charges. Together they can do both, creating benefits greater than the sum of both of them individually. However, this adds to the complexity of the overall system, and creates important challenges for distributed energy system designers, who have to contend with multiple variables.

In addition, as electricity demand remains flat across the country, and as renewable energy penetration is increasing, utilities are looking for ways to better manage peak demand and recover the costs of their fixed infrastructure. California utilities are introducing new Time-of-Use rates that combine with demand charges to provide new price signals to commercial consumers. So, added to the complexity of varying customer load profiles, system types and climate constraints, is the prospect of ongoing change in utility tariffs that track with fast-moving developments in energy technology. Time-of-Use rates introduce new incentives that affect how storage should be charged and discharged, increasing the analytical challenge of getting the most return from an investment in solar- plus-storage.

HOMER Grid, a new software product from HOMER® Energy, which will be released in late March of 2018, is designed to manage the complexity that goes into distributed energy resource decisions, whether it’s solar-plus-storage, or other combinations including CHP and generators. Incorporating the continuously updated Genability utility tariff database, HOMER Grid will take inputs on customer load profile types and utility tariffs (from the US, Canada, Mexico and Australia), and determine optimally sized hybrid renewable energy systems. Then it will run simulations for thousands of different types of system configurations for every hour of the year, and rank the results by financial performance.

If you’re interested in finding out whether a distributed energy resource or hybrid system is a good investment for you, you can download a trial version of HOMER Grid, or do some preliminary modeling with our free web version of HOMER Grid. Just visit HOMER QuickGrid, follow the directions, and wait for an interesting report on the savings you might expect.

Great news Peter – itâs time you introduced this capability. Iâd love to connect to discuss.

Thank you for commenting on our blog. We have passed your comment along to Dr. Lilienthal.