This blog post was written by Peter Asmus, Principal Research Analyst at Navigant Research. HOMER Energy is proud to be a media sponsor of Navigant’s upcoming webinar on October 24th: Data Centers and Advanced Microgrids.

The forecasted growth of Internet of Things devices and the rapid uptake of cloud-based applications to manage the emerging digital economy speak to a fundamental fact: the role data centers will play in our lives will continue to grow exponentially over time. Millennials are growing up in a world where data drives their lives. One million new devices are expected to come online per hour by 2020. By 2025, 60% of computing is expected to take place in the cloud.

Data centers need to maintain uptime under all circumstances. The digitization of products and services is largely dependent upon them having reliable electricity. Yet recent trends paint a disturbing picture. The average power outage cost for a data center in 2015 was $740,357, a 38% increase in the cost of downtime compared to 2010. Perhaps the most disturbing statistic found in the Eaton Blackout Tracker 2016 annual report is the increase in maximum downtime cost rose 81% in 2015 compared to 2010, amounting to $2.4 million per outage.

If data centers do not take advantage of new energy technology innovations and business models, massive inefficiency could doom the so-called fourth industrial revolution’s promise of sustainability via digital innovations, the focus of a long list of corporate giants seeking profit in the emerging markets for cleaner products and processes.

No doubt, data centers are pioneers in corporate sustainability. In 2016, data centers signed contracts to purchase 1.2 GW of renewable energy. The Business for Social Responsibility’s Future of Internet Power program features 12 large data center companies representing a trillion dollars in market cap. Each of these Internet giants have committed to reducing their respective carbon footprints by adhering to green energy protocols embodied in a set of corporate colocation principles. On the surface, these statistics and efforts appear impressive. However, these achievements rely, for the most part, upon the purchase of renewable energy credits (RECs) to offset actual emissions from onsite distributed generation such as diesel generators and utility grid power still often dominated by fossil fuel combustion.

“Smarts not parts,” is how Patrick Flynn, senior director of sustainability for Salesforce sums up the necessary shift in thinking, “Software is the key. Don’t really need two of everything to insure resilience.” He is quick to add that the investments Salesforce has made to reach its goal of 100% renewable energy, net-zero greenhouse gas emissions target, and a carbon neutral cloud did stimulate the development of two new wind farms at a fixed price, rather than REC purchases from existing facilities. “When we look back in time 5 years from now, data centers will be viewed as pioneers with microgrids, but I believe they’ll also be forging tighter relationships with utilities, especially those in rural geographies such as Oregon and Texas, where data center loads and the jobs they create will be particularly appealing.”

Data Center Market Trends

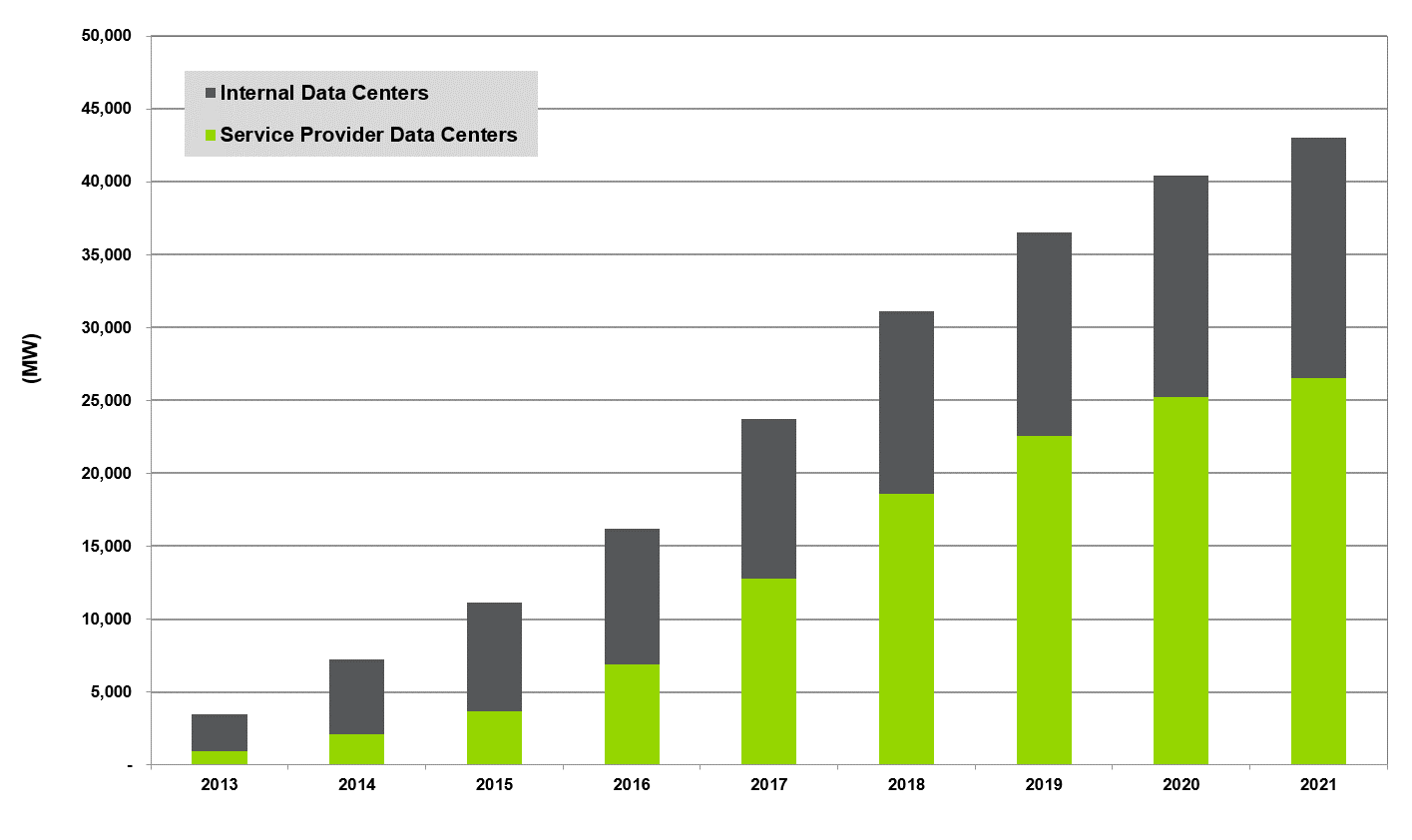

Tracking the growth of data centers is a bit of a zig-zag exercise, with some market segments shrinking while others pick up steam. If one focused on annual capacity additions, service provider data centers will add almost 7,000 MW of capacity in 2018, the fastest pace of expansion recorded according to estimates derived from IDC data. Upon closer examination of cumulative market growth, there is a shift away from ownership (internal data centers) to reliance upon service provider data centers, which includes colocation facilities. This shift is being driven by smaller data centers relying upon a public cloud, and wanting to shift responsibility for data centers to third-party experts.

Chart 1.1 Cumulative Data Center Capacity, World Markets: 2013-2021

In short, data centers are moving away from direct ownership of hard assets and seeking resiliency and efficiency via the cloud and the virtualization of energy services. This is setting the stage for creative solutions providers to offer up new technologies via new business models that can mitigate risks while increasing performance through options like advanced microgrids.

Shifting from a Sole Internal Focus to Bidirectional Value Exchanges

As one utility representative noted, “Every second is money to a data center.” This is one reason data centers do not often participate in demand response (DR) programs, he observed. Often, the amount of revenue generated from participation in a DR event is minimal when compared to the large costs of a power outage perhaps created by participation in such a program. Furthermore, the acronym DR also means “disaster recovery” to most data centers operators, further tainting the term in their minds. Yet another challenge is that many backup diesel generators are only allowed to operate during an emergency due to their high emissions profiles. Utility DR programs are not considered an emergency.

But the times they are a changing. Lance Black, founder and CEO of Vazata, a managed cloud provider for colocation data centers, is trying a new approach with a data center being developed in McKinney, Texas that focuses on utility interdependency.

The data center lacks both onsite backup diesel generators and an uninterrupted power supply. As an alternative, it is relying upon lithium ion batteries charged up by the local utility. “We decided to take this route because it was the most efficient use of resources. It’s all about cost,” said Black. He added, “I had become frustrated by seeing batteries in the basement and an array of generators and the only time they were ever used was when we were doing maintenance mode. We thought there was a better way to reduce costs for our customers.” He investigated onsite solar PV, and may still go that route, but instead started with the batteries in this modular approach. The data center is starting at 0.5 MW, but the plan is to grow this modular system incrementally over time. “Two to 3 years from now, we hope to be adding solar PV,” he acknowledged. “We are also selling back power to the local utility to reduce bills.” This latter approach is a significant step forward for the data center industry as interest in concepts such as virtual power plants (VPPs) piggyback on the implementation of advanced microgrids.

Shifting from CAPEX to OPEX Optimization

The closest existing microgrid market to face similar issues as data centers is the US military, where historic reliance upon backup diesel generators has been the status quo. And like the military, the data center market may need to rely upon new business models to drive innovation.

One such approach is microgrids as a service (MaaS), which Schneider Electric is pioneering with Montgomery County and at one of its own data centers at Boston One. As Carsten Bauman, strategic alliance manager at Schneider Electric, describes it, “the data center industry needs to move from a sole focus on self-generation as a resilience strategy to a grid interdependent power architecture.” Advanced microgrids being transformed into VPPs is one pathway to reach this new approach. MaaS is a promising way to attack the number one barrier to moving forward with this utility interdependency shift: reduction of CAPEX and assumption of OPEX by seasoned solutions providers. Just as the data center market in general is moving toward service provider and colocation facilities, a similar trend away from internal management of resilience infrastructure is underway. This shift to a more advanced, efficient, and sustainable power infrastructure is now possible within the typical constraints that have historically thwarted such efforts for data centers in the past. The data center industry is too important to stay stuck in a conservative and polluting approach to uptime.

To learn more on this topic, check out a webinar featuring Navigant Research, Schneider Electric and Salesforce on October 24th.