Microgrids are a global phenomenon. Yet, a clear definition of what is and what is not a microgrid is still open to debate. The only government agency to define a microgrid is the U.S. Department of Energy (DOE), which identifies a microgrid as:

“A group of interconnected loads and distributed energy resources (DER) within clearly defined electrical boundaries that act as a single controllable entity with respect to the grid. A microgrid can connect and disconnect from the grid to enable it to operate in both grid-connected and island-mode.”

Navigant Research has broadened this widely accepted definition of a microgrid to include remote systems in its analysis. Remote microgrids are networks that are not typically interconnected with any utility grid or may interconnect with a highly unreliable grid; therefore, they operate in island mode for a majority of the time. It was these remote, off-grid systems that were first called microgrids decades ago.

Navigant recently published the latest in its ongoing series of tracking reports focused on the global microgrid market. The firm’s microgrid database is updated biannually and covers five microgrid market segments and four principal geographies. It lists operating, planned/under development, and proposed microgrids, as well as selected projects that lay the foundation for viable microgrids over the next seven years.

New Findings and Insights

According to the latest report, many new microgrids are still under the radar and, consequently, have not yet made it into this database. Some vendors claim to have project portfolios with as many as 30 projects, but due to client sensitivity and a desire to remain opaque in business development efforts, did not reveal project details for publication in this report. Navigant focused on the remote microgrid segment in this latest update; therefore, it should come as no surprise that this segment features the largest increase: the addition of 86 new projects representing 195 MW of additional capacity. This represents, by far, the largest number and capacity additions to this database. The second largest source of new microgrids was in the community/utility segment, followed closely by the commercial/industrial segment.

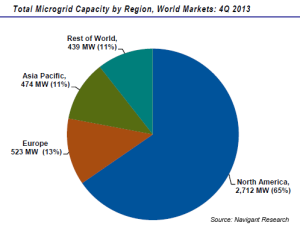

The picture is one of a much more robust microgrid market than in 2009, when Navigant first began to develop its database and commercial analysis of this corner of the smart grid movement. New vendors continue to enter this space and previously undiscovered projects keep coming to the fore. As of this update, the research firm has identified a total of 4,148 MW of total microgrid capacity throughout the world, up from 3,793 MW in the previous update in 2Q 2013. The total number of new project entries as of October 2013 was 117.

This latest microgrid report reinforces the premise that North America is the world’s most fertile environment for microgrids. As a region, North America is still the world’s leading market for microgrids with a planned, proposed, and deployed capacity of 2,712 MW. This represents an additional 34 projects and an additional 207 MW since the firm’s 2Q 2013 microgrid report. Of the total North American microgrid capacity, 1,503 MW is currently online and more than 1,224 MW is in the planned/under development or proposed phase.

Most microgrids up and running today are, in essence, retrofit projects, cobbling together existing assets and deriving revenue from an overlay of controls used to enable legacy technology (consisting of the majority of the assets within the microgrid) to talk to the new technology (usually small amounts of solar photovoltaic or a new advanced energy storage unit). Today, however, microgrids are beginning to move more into the mainstream, with a greater focus being placed on viable business models, according to Navigant.

Source: Excerpted from Microgrid Deployment Tracker 4Q13 by Navigant Research. Reprinted with permission.